Zoho Invoice isn’t just another invoicing software; it’s your all-in-one solution for managing client payments, tracking expenses, and streamlining your entire billing process. This guide dives deep into Zoho Invoice’s features, integrations, and overall value proposition, covering everything from its intuitive interface to its robust reporting capabilities. Whether you’re a solopreneur or running a large enterprise, we’ll explore how Zoho Invoice can boost your business efficiency and make invoicing a breeze.

We’ll unpack the various pricing plans, explore its seamless integrations with other business tools, and show you how to customize invoices to perfectly reflect your brand. We’ll also delve into the security measures Zoho employs to keep your financial data safe and secure. Get ready to master Zoho Invoice and take your invoicing game to the next level!

Zoho Invoice Features Overview

Zoho Invoice is a cloud-based invoicing software designed to streamline billing processes for freelancers, small businesses, and enterprises. It offers a comprehensive suite of features aimed at simplifying invoice creation, tracking payments, and managing client relationships. This overview will explore its core functionalities, pricing, interface, and compare it to a competitor.

Core Functionalities, Zoho invoice

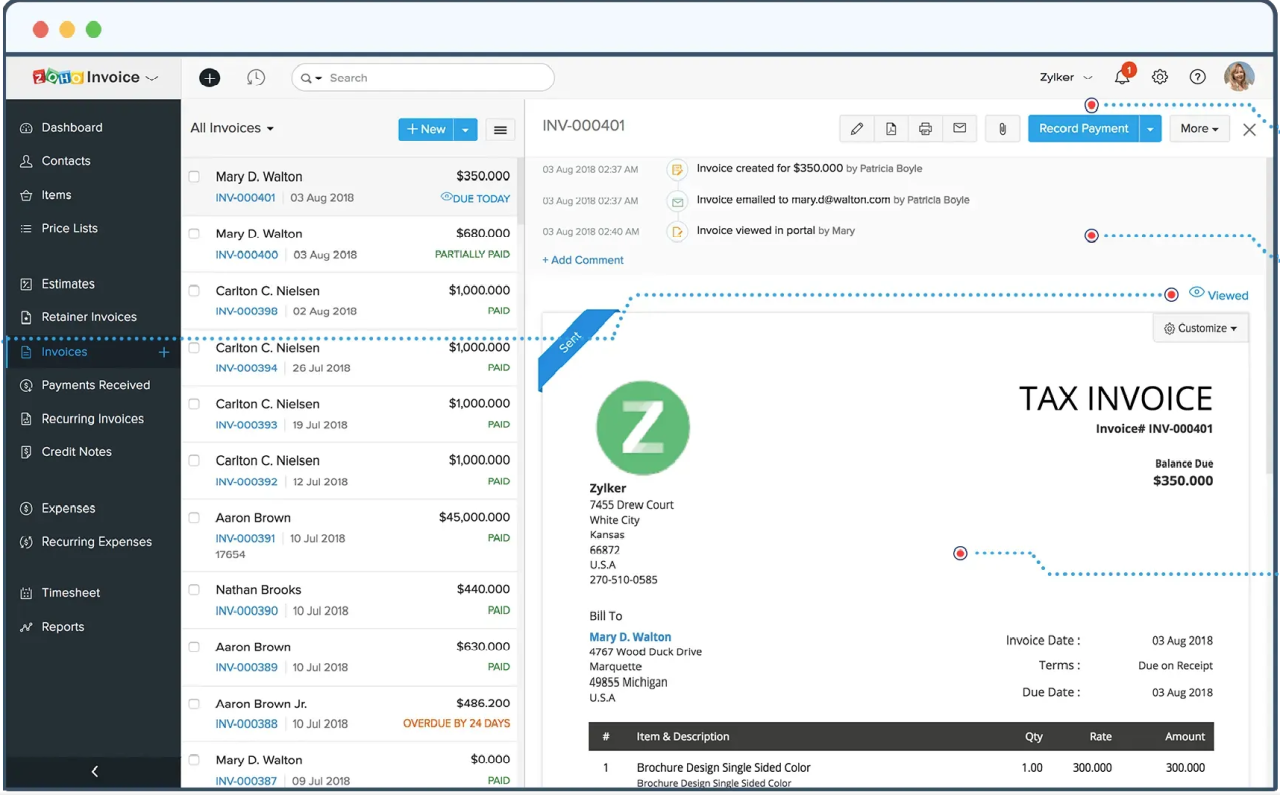

Zoho Invoice provides a robust set of features to manage the entire invoicing lifecycle. Users can create professional-looking invoices, track expenses, manage recurring invoices, send payment reminders, and generate reports. The platform also integrates with other Zoho applications and third-party tools, expanding its capabilities. Key features include customizable invoice templates, multiple payment gateway integrations, expense tracking with receipt uploads, and detailed financial reporting.

These features collectively contribute to efficient billing and financial management.

Pricing Plans and Features

Zoho Invoice offers several pricing plans to cater to different business needs and scales. These plans typically range from free options with limited features to premium plans offering advanced functionalities. The free plan usually allows a limited number of invoices and clients, while paid plans unlock features like automated payment reminders, advanced reporting, and multiple user access. Specific feature sets vary across plans, so careful review of the pricing page on the Zoho website is recommended before selecting a plan.

For example, a higher-tier plan might include features like multi-currency support or advanced inventory management, while a lower-tier plan might only offer basic invoicing capabilities.

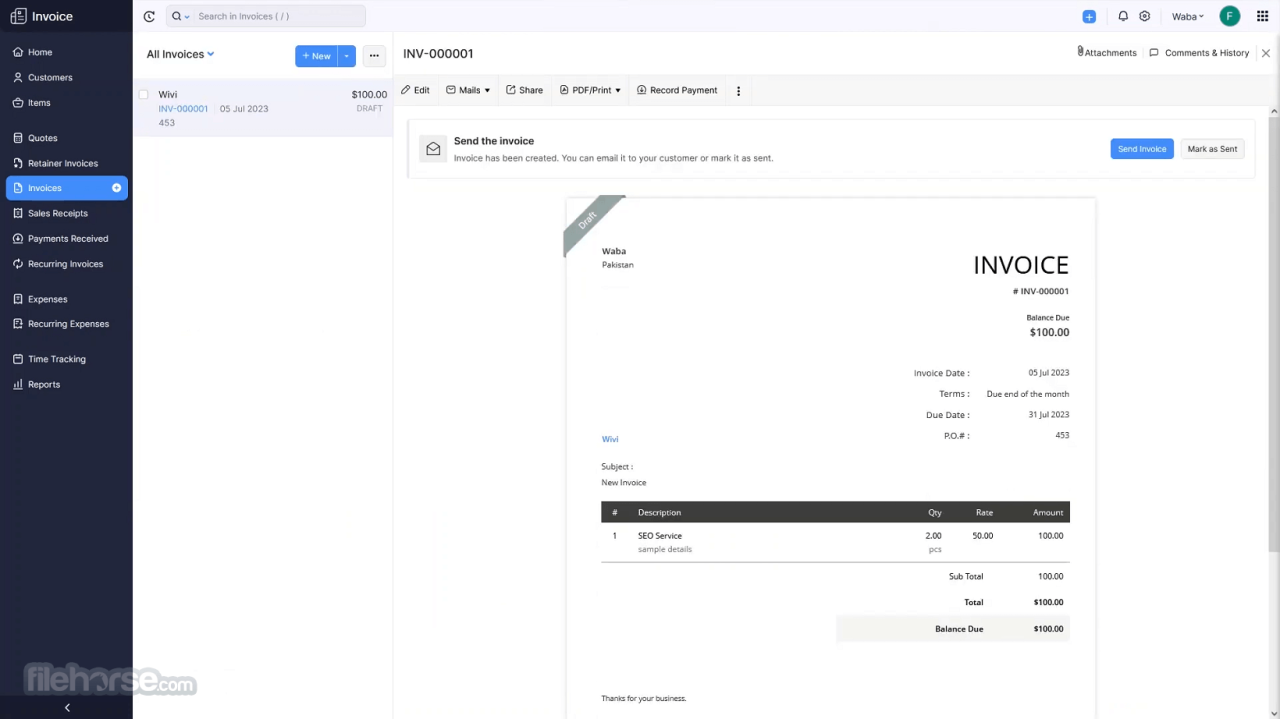

User Interface and Navigation

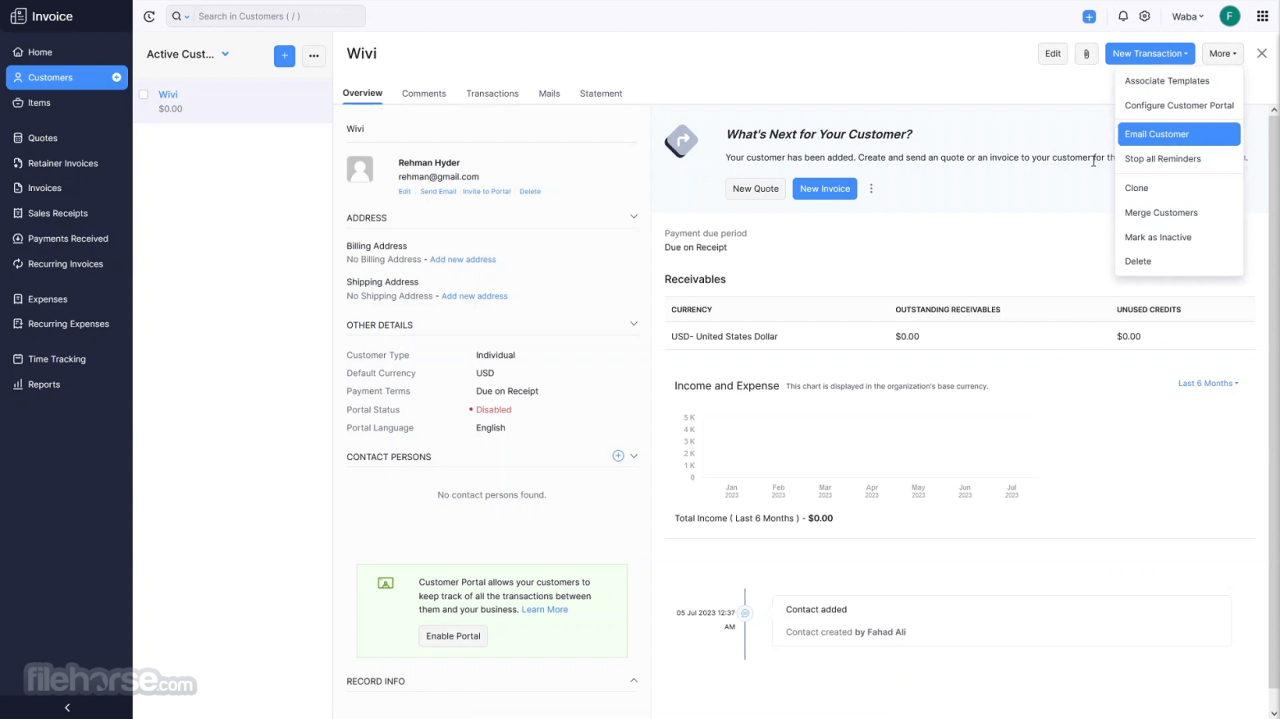

Zoho Invoice boasts a user-friendly interface designed for intuitive navigation. The dashboard presents a clear overview of key metrics, such as outstanding invoices and upcoming payments. The menu structure is straightforward, allowing users to quickly access different modules, such as invoice creation, client management, and reporting. The platform’s clean design and logical organization make it easy to learn and use, even for users with limited experience in accounting software.

The overall experience is designed to be efficient and minimize the time spent on administrative tasks.

Zoho Invoice vs. Xero

| Feature | Zoho Invoice | Xero | Notes |

|---|---|---|---|

| Pricing | Offers a free plan and several paid plans with varying features. | Primarily subscription-based with different plans for varying business sizes. | Both offer a range of options, but pricing structures differ significantly. |

| Invoice Customization | Highly customizable templates and branding options. | Offers customization, but options might be slightly less extensive than Zoho. | Both allow branding, but Zoho’s template options might be considered more diverse. |

| Reporting | Provides a range of reports, including financial summaries and sales reports. | Offers comprehensive reporting features, including real-time dashboards. | Xero’s reporting is generally considered more robust for in-depth financial analysis. |

| Integrations | Integrates with other Zoho applications and some third-party tools. | Integrates with a wide range of third-party apps and services. | Xero has a broader ecosystem of integrations compared to Zoho. |

Zoho Invoice Integrations

Zoho Invoice isn’t just a standalone invoicing tool; it’s a central hub designed to seamlessly integrate with other essential business applications. This interconnectedness streamlines workflows, reduces manual data entry, and ultimately saves you time and frustration. By connecting Zoho Invoice to your other software, you create a more efficient and powerful business management system.Zoho Invoice offers a wide range of integrations, allowing businesses to connect their invoicing with various other aspects of their operations.

These integrations help automate tasks, improve data accuracy, and provide a more holistic view of the business’s financial health. The benefits extend from improved customer relationship management to more efficient expense tracking and project management.

Key Zoho Invoice Integrations and Their Benefits

Several key integrations significantly enhance Zoho Invoice’s functionality. These integrations automate data transfer, reducing manual effort and the risk of errors. They also provide a centralized view of your business operations, improving decision-making.

- Zoho CRM: This integration synchronizes customer data between Zoho Invoice and Zoho CRM. Invoices are automatically linked to customer records, providing a complete history of interactions and payments. This eliminates the need for manual data entry and ensures consistency across platforms. The benefit is a unified view of your customer interactions and financial transactions.

- Zoho Books: This integration allows for seamless transfer of invoice data to Zoho Books, your accounting software. This automates the accounting process, reducing errors and saving significant time. The benefit is improved accuracy and efficiency in financial reporting.

- PayPal: Accept online payments directly through Zoho Invoice using PayPal. This simplifies the payment process for both you and your clients. The benefit is faster payment processing and improved cash flow.

- Stripe: Similar to PayPal, Stripe integration enables secure online payment processing directly within Zoho Invoice. This offers another convenient and widely-accepted payment gateway for clients. The benefit is enhanced payment flexibility and reduced reliance on manual payment collection.

- Google Drive: Store and access invoices and related documents directly from Google Drive. This centralizes document storage and facilitates easy sharing and collaboration. The benefit is improved document organization and accessibility.

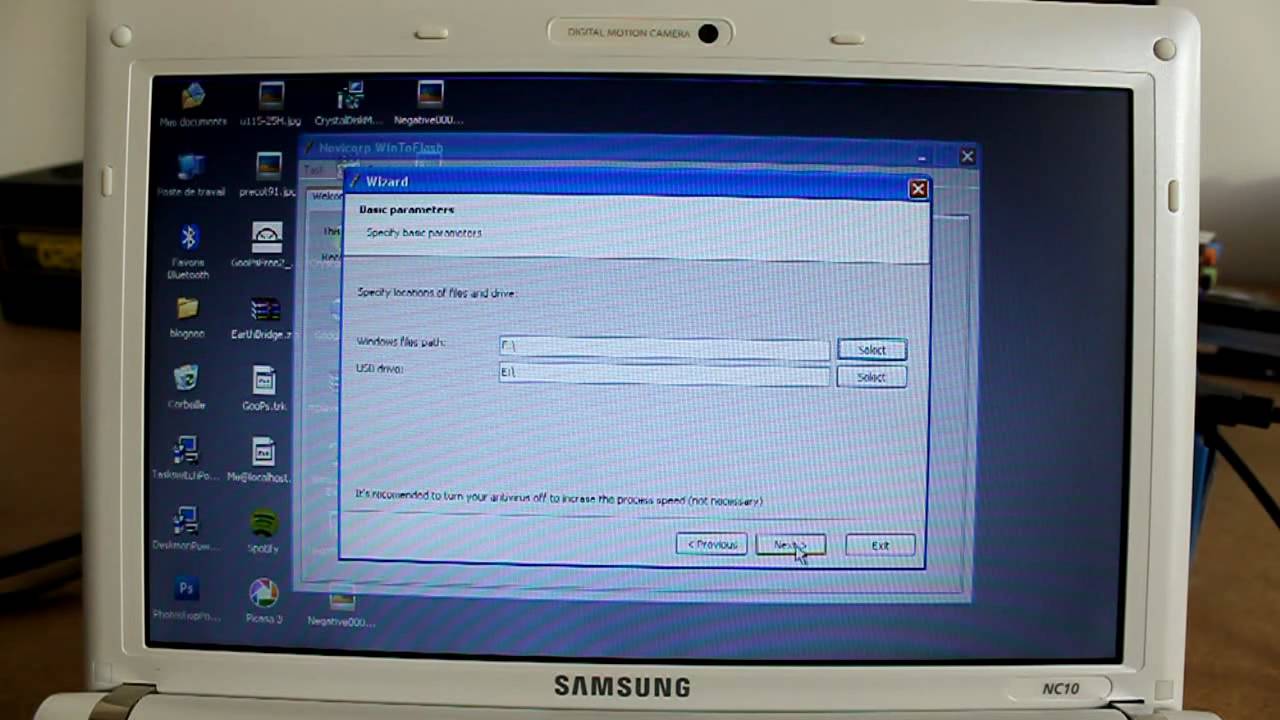

Setting Up a Zoho CRM Integration

Setting up an integration with Zoho CRM involves a straightforward process within the Zoho Invoice settings. First, you’ll need to ensure both Zoho Invoice and Zoho CRM accounts are active and accessible. Then, navigate to the Integrations section within Zoho Invoice settings. Locate the Zoho CRM integration and click to enable it. You’ll likely need to authorize Zoho Invoice to access your CRM data.

After authorization, you can map specific fields between the two systems, ensuring data consistency. For instance, you might map the “Customer Name” field in Zoho Invoice to the “Company Name” field in Zoho CRM. Once the mapping is complete, the integration is active, and data will begin syncing automatically.

Zoho Invoice and Zoho CRM Data Flow

The following flowchart illustrates the data flow between Zoho Invoice and Zoho CRM after integration setup.

[Imagine a flowchart here. The flowchart would start with a “Create Invoice” box in Zoho Invoice. An arrow would point to a “Customer Data Retrieved” box, showing data pulled from Zoho CRM. Another arrow would point to a “Invoice Created and Linked to CRM Contact” box. Finally, an arrow would point to a “Payment Recorded” box in Zoho Invoice, which would have another arrow pointing back to a “Payment Updated in CRM Contact” box in Zoho CRM.

This visual representation demonstrates the bidirectional data flow between the two systems.]

Zoho Invoice for Different Business Sizes

Zoho Invoice is a surprisingly versatile invoicing solution, scaling effectively to meet the needs of businesses ranging from solopreneurs to large corporations. Its adaptability lies in its flexible feature set and customizable options, allowing users to tailor the platform to their specific requirements and growth trajectory. This means a small bakery can use it just as effectively as a multinational tech firm, albeit leveraging different aspects of the software.

The core functionality remains consistent across all business sizes, focusing on streamlined invoicing, expense tracking, and payment processing. However, the strategic implementation and emphasis on certain features differ significantly depending on the scale and complexity of the business.

Zoho Invoice for Small Businesses

Small businesses, often characterized by lean teams and simpler operational structures, benefit most from Zoho Invoice’s ease of use and affordability. The intuitive interface minimizes the learning curve, allowing owners to quickly master the system and focus on their core business activities. Key features for this segment include automated invoice generation, basic expense tracking, and straightforward payment processing through integrated gateways.

A small freelance writer, for instance, can easily create and send invoices, track client payments, and manage expenses all within the same platform, streamlining their administrative tasks. A local bakery can use it to manage invoices for wholesale clients and retail sales.

Here’s a breakdown of valuable features for small businesses:

- Easy-to-use interface: Minimal training required for quick adoption.

- Automated invoicing: Saves time and reduces manual errors.

- Basic expense tracking: Provides a clear overview of business spending.

- Integrated payment gateways: Simplifies the payment collection process.

- Affordable pricing plans: Fits within the budget constraints of startups and small businesses.

Zoho Invoice for Large Enterprises

Large enterprises, with their intricate operational structures and diverse client bases, require a more robust and scalable invoicing solution. Zoho Invoice caters to this need through advanced features like multi-user access, detailed reporting and analytics, custom branding options, and seamless integration with other enterprise-level applications. A large consulting firm, for example, might utilize Zoho Invoice’s advanced features to manage invoices for multiple projects, track team member contributions, and generate comprehensive financial reports for stakeholders.

A large retail chain could use it to manage invoices across multiple locations and integrate it with their inventory management system.

The following features are particularly beneficial for larger organizations:

- Multi-user access and roles: Enables efficient collaboration and task delegation within teams.

- Advanced reporting and analytics: Provides in-depth insights into financial performance.

- Custom branding options: Allows for consistent brand messaging across all invoices.

- Extensive integrations: Seamlessly connects with other enterprise software for streamlined workflows.

- Scalability and customization: Adapts to the growing needs of the business.

Zoho Invoice Across Various Industries

Zoho Invoice’s adaptability extends across various industries. Freelancers can leverage its simplicity for efficient invoicing and payment tracking. Retail businesses can utilize it to manage sales invoices, integrate with point-of-sale systems, and track inventory. Service-based businesses can use it to create customized invoices, track project progress, and manage expenses related to each project. The platform’s flexibility allows it to adapt to the specific needs of each industry, making it a versatile tool for diverse business models.

For example, a marketing agency can track client projects, allocate expenses, and generate detailed invoices for each client’s deliverables. A construction company can track project milestones, manage materials costs, and create invoices based on completed work phases.

Zoho Invoice Customization Options

Zoho Invoice offers a surprisingly robust suite of customization options, letting you tailor your invoices to perfectly match your brand and workflow. This goes beyond just slapping your logo on; you can deeply personalize the look and feel, automate crucial processes, and ultimately create a more professional and efficient invoicing system. Let’s dive into the specifics.

Customizing your Zoho Invoice experience is all about creating a system that works for you, not the other way around. From the smallest detail of font choice to the larger-scale automation of email notifications, the level of control is impressive. This means less time spent on tedious tasks and more time focusing on what matters most – growing your business.

Invoice Branding and Customization

Zoho Invoice allows you to inject your brand identity directly into your invoices. This involves uploading your company logo, choosing your brand colors, and selecting fonts that reflect your style. You can also customize the header and footer to include essential information like your address, contact details, and tax registration number. Imagine your logo prominently displayed at the top, followed by your carefully chosen color scheme – it immediately professionalizes your invoices and strengthens brand recognition.

Think of it as a mini-marketing opportunity with every invoice sent.

Creating Custom Invoice Templates

Creating custom invoice templates is a straightforward process within Zoho Invoice. You can start with one of their pre-built templates and modify it, or build one from scratch. This involves selecting the layout, adding or removing sections, adjusting the placement of information, and fine-tuning the overall design. Consider the layout’s clarity and readability; a well-designed template makes it easy for clients to understand and pay their invoices promptly.

For instance, you could create a template with a prominent “Pay Now” button, directly linking to your preferred payment gateway.

Setting Up Automated Email Notifications

Automating email notifications streamlines your invoicing process and ensures timely payments. Zoho Invoice lets you set up automatic email notifications for various events, such as invoice creation, overdue payments, and payment reminders. You can customize these emails to include specific messages and branding, maintaining a consistent tone and professional image. For example, you could set up a notification that’s sent three days before an invoice is due, gently reminding the client of the upcoming payment.

This proactive approach reduces late payments and improves cash flow.

Customizing the Invoice Layout: A Step-by-Step Guide

Let’s walk through a simplified example of customizing your invoice layout. Remember, these steps are illustrative and the exact screens might vary slightly depending on your Zoho Invoice version.

- Access Invoice Settings: Navigate to the “Settings” section of your Zoho Invoice account. You’ll typically find this in a menu or dashboard.

- Select “Invoice Settings”: Within the “Settings” menu, locate and select the “Invoice Settings” option. This will bring you to the customization area.

- Customize Appearance: This section usually allows you to adjust elements like fonts, colors, and the placement of various invoice details (company logo, address, etc.). Imagine a screen with fields for uploading your logo, selecting fonts from a dropdown menu, and choosing colors using color pickers.

- Preview Changes: Most systems allow you to preview your changes in real-time before saving them. This is crucial for ensuring that the invoice looks exactly as intended. Picture a screen showing a sample invoice with your selected customizations applied.

- Save Changes: Once you’re satisfied, save your changes. This will update the template for all future invoices you generate.

Zoho Invoice Reporting and Analytics

Zoho Invoice offers a robust suite of reporting and analytics tools designed to give you a clear picture of your business finances. Understanding these reports is key to making informed decisions about pricing, expenses, and overall business strategy. You can easily track key metrics, identify areas for improvement, and ultimately boost your bottom line. Let’s dive into the specifics.Zoho Invoice’s reporting capabilities provide valuable insights into various aspects of your business’ financial health.

This allows for data-driven decision-making, helping you to optimize your invoicing process and improve profitability.

Available Report Types

Zoho Invoice provides a range of pre-built reports, categorized for easy access and understanding. These reports cover everything from sales performance and outstanding invoices to expense tracking and payment summaries. Users can easily filter reports by date, customer, and other criteria to gain more specific insights. Examples include sales reports, expense reports, payment reports, overdue invoices reports, and customer reports.

These offer a comprehensive overview of financial activity within a customizable timeframe.

Generating and Interpreting Key Performance Indicators (KPIs)

Generating KPIs from Zoho Invoice reports involves selecting the relevant report and focusing on key metrics. For example, to track revenue growth, you’d examine the total revenue reported over different periods. To calculate the average invoice value, you can divide the total revenue by the number of invoices issued. Interpreting these KPIs requires understanding what they represent and comparing them to previous periods or industry benchmarks.

A significant drop in average invoice value, for instance, might indicate a need to review pricing strategies. Similarly, a high percentage of overdue invoices might signal the need for stricter payment terms or improved collections practices. The key is to consistently monitor these KPIs to identify trends and make proactive adjustments.

Tracking Revenue, Expenses, and Outstanding Payments

Zoho Invoice simplifies the tracking of revenue, expenses, and outstanding payments. Revenue tracking is straightforward, using the sales reports which detail income from invoices. Expense tracking is equally easy; Zoho Invoice allows you to record expenses directly, and these are then summarized in dedicated expense reports. Outstanding payments are clearly visible in the overdue invoices report, highlighting invoices that haven’t been paid within the specified timeframe.

This allows for timely follow-up with clients and proactive management of cash flow. These features work together to provide a holistic view of your financial position.

Sample Report: Sales Performance Overview

Let’s imagine a sample sales report covering the month of October 2023. The report would show a total revenue of $15,000, generated from 50 invoices. The average invoice value would be $300 ($15,000 / 50 invoices). The report might further break down revenue by customer or product, showing that Customer A contributed $5,000, while Customer B contributed $3,000, and so on.

This level of detail allows for identifying top-performing customers and products, enabling targeted marketing or sales efforts. Additionally, the report could include information on payment methods used, such as credit card, bank transfer, or other options. This information is invaluable for understanding customer preferences and optimizing payment processing. This comprehensive view allows for informed business decisions based on real-time data.

Zoho Invoice Mobile App Functionality

Zoho Invoice’s mobile app brings the power of invoice management right to your fingertips, allowing you to stay on top of your business finances wherever you are. It’s designed to mirror many of the desktop version’s features, offering a streamlined experience for quick actions and essential tasks. This allows for efficient invoice management even when you’re away from your computer.The Zoho Invoice mobile app offers a subset of the features found in the desktop version, prioritizing functionality crucial for on-the-go management.

While it lacks some of the more advanced reporting and customization options, it excels at core invoice-related tasks. Think of it as a highly efficient, portable version of the main software.

Mobile App Features

The Zoho Invoice mobile app allows users to create and send invoices, track payments, manage expenses, and view client details. It also provides access to key reports, offering a quick overview of financial performance. Specific features include invoice creation with customizable templates, payment tracking with real-time updates, and the ability to quickly access client information. Users can also add expenses directly to the app, streamlining expense tracking.

This functionality helps maintain a constant connection to your business finances regardless of location.

Comparison to Desktop Version

The desktop version of Zoho Invoice provides a much broader range of features including more detailed reporting, advanced customization options for invoices and branding, and more robust integration capabilities. The mobile app prioritizes core functionalities, offering a simplified user experience ideal for quick actions. Think of it like this: the desktop version is a fully equipped workshop, while the mobile app is a well-stocked toolbox – perfect for quick fixes and essential tasks on the go.

The desktop version allows for more in-depth analysis and customization, while the mobile app focuses on quick access and immediate action.

Benefits of Mobile App Usage

Using the Zoho Invoice mobile app offers several key advantages. First, it enables real-time invoice management, allowing you to create and send invoices immediately, regardless of location. Second, it facilitates efficient payment tracking, providing instant updates on outstanding invoices. Third, it offers convenient access to client information, enabling quick responses to inquiries. Finally, it enhances productivity by allowing you to manage your business finances even outside of traditional office hours.

For example, a freelancer could create an invoice for a completed project immediately after a client meeting, ensuring timely payment.

User Story: Mobile App in Action

Imagine Sarah, a freelance graphic designer. She just finished a logo design project for a new client, “Coffee Cravings,” at a local coffee shop. Using the Zoho Invoice mobile app on her phone, Sarah quickly creates a new invoice, selecting the appropriate template and filling in the client’s details and the project cost. She attaches a digital copy of the approved design files.

With a few taps, she sends the invoice directly to Coffee Cravings via email. Later that day, while commuting home, Sarah checks the app and sees that Coffee Cravings has already viewed the invoice. The next day, she receives a payment notification through the app, updating her invoice status to “Paid.” This entire process, from invoice creation to payment confirmation, happened seamlessly using the Zoho Invoice mobile app, allowing Sarah to manage her business efficiently on the go.

Zoho Invoice Security and Data Privacy

Zoho Invoice understands that security and data privacy are paramount for businesses of all sizes. They’ve implemented a robust suite of measures to protect your sensitive financial information and ensure compliance with industry best practices. This section details the security features and certifications that underpin Zoho Invoice’s commitment to data protection.Zoho Invoice employs a multi-layered security approach to safeguard user data.

This includes physical security measures at their data centers, network security protocols to prevent unauthorized access, and regular security audits to identify and address potential vulnerabilities. They also leverage advanced technologies to detect and prevent malicious activities, constantly adapting their security posture to counter emerging threats.

Data Encryption Methods

Zoho Invoice utilizes various encryption methods to protect data both in transit and at rest. Data in transit is secured using HTTPS with TLS 1.2 or higher, ensuring that all communication between your browser and Zoho’s servers is encrypted. Data at rest, meaning the data stored on Zoho’s servers, is also encrypted using robust encryption algorithms, providing an additional layer of protection against unauthorized access even if a breach were to occur.

The specific algorithms used are regularly updated to maintain the highest levels of security.

Compliance Certifications

Zoho Invoice adheres to several internationally recognized security and privacy standards. They have achieved ISO 27001 certification, demonstrating their commitment to establishing, implementing, maintaining, and continually improving an Information Security Management System (ISMS). This certification validates Zoho Invoice’s rigorous approach to data security and risk management. Additionally, they comply with other relevant regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), depending on the location of the user’s data.

Key Security Features

The following points summarize the key security features implemented by Zoho Invoice:

- Data Encryption: Both data in transit and at rest are encrypted using industry-standard algorithms.

- Access Controls: Role-based access controls allow administrators to manage user permissions and restrict access to sensitive information.

- Regular Security Audits: Zoho conducts regular security audits and penetration testing to identify and address vulnerabilities.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring users to provide a second form of verification beyond their password.

- Intrusion Detection and Prevention Systems (IDPS): Zoho employs IDPS to monitor network traffic and detect and prevent malicious activities.

- Compliance Certifications: Zoho Invoice holds certifications such as ISO 27001, demonstrating its commitment to data security.

- Data Backup and Disaster Recovery: Zoho maintains robust backup and disaster recovery plans to ensure business continuity and data protection in the event of unforeseen circumstances.

Zoho Invoice Customer Support and Resources

Navigating any new software can be tricky, and Zoho Invoice is no exception. Luckily, Zoho provides a robust suite of support channels and online resources to help users get the most out of the platform, from troubleshooting minor issues to mastering advanced features. Understanding these resources is key to a smooth and efficient invoicing process.

Zoho Invoice Support Channels

Zoho offers a multi-faceted approach to customer support, ensuring users can access assistance through their preferred method. This variety caters to different learning styles and urgency levels.

| Support Channel | Description |

|---|---|

| Help Center/Knowledge Base | A comprehensive online library of articles, FAQs, and tutorials covering virtually every aspect of Zoho Invoice. This is a great first stop for troubleshooting common problems or learning new features. The search functionality is quite powerful, allowing you to quickly find relevant information. |

| Email Support | For more complex issues or situations requiring personalized assistance, Zoho offers email support. Users can submit detailed descriptions of their problem, including screenshots if necessary, and expect a response within a reasonable timeframe. Response times may vary depending on the complexity of the issue and the current support volume. |

| Phone Support | While not always readily available for all plans, some Zoho Invoice subscriptions include access to phone support. This offers a direct line to a support representative who can provide immediate assistance. This is ideal for urgent situations requiring immediate resolution. |

| Community Forums | Zoho maintains active community forums where users can connect with each other, share tips, and ask questions. This peer-to-peer support network can be a valuable resource for finding solutions and learning from others’ experiences. You might find your problem has already been solved! |

| Live Chat | For quick answers to simple questions, a live chat option might be available directly within the Zoho Invoice application. This provides immediate assistance for minor issues without the need for email or phone calls. Availability may depend on your plan and the time of day. |

Submitting a Support Ticket

The process for submitting a support ticket typically involves logging into your Zoho Invoice account, navigating to the support section (often found in the settings or help menu), and filling out a form detailing your issue. Be sure to provide as much relevant information as possible, including screenshots, error messages, and the steps you’ve already taken to troubleshoot the problem.

Clear and concise communication will help the support team quickly understand and resolve your issue. Zoho often uses a ticketing system, allowing you to track the progress of your request and receive updates.

Online Resources and Documentation

Zoho provides extensive online resources to aid users in navigating the platform. These resources are regularly updated to reflect the latest features and changes. The Help Center is a central hub for this information, containing a wealth of articles, tutorials, and video guides covering various aspects of Zoho Invoice, from basic setup to advanced customization. These resources are designed to empower users to independently solve problems and learn new functionalities at their own pace.

They often include step-by-step instructions and screenshots to make the learning process easier.

Zoho Invoice Pricing and Value Proposition

Zoho Invoice offers a tiered pricing structure designed to cater to businesses of all sizes, from solopreneurs to larger enterprises. Understanding its pricing model is crucial to determining whether it’s the right invoicing solution for your specific needs and budget. This section will compare Zoho Invoice’s pricing to its competitors, analyze its overall value proposition, and explain how its pricing scales with business growth.Zoho Invoice’s pricing is competitive within the invoicing software market.

While exact pricing varies based on currency and specific features, it generally offers a more affordable option compared to some premium competitors, while still providing a robust feature set. This makes it particularly attractive to small businesses and startups operating on tighter budgets. However, features like advanced automation and extensive integrations might cost more than some basic alternatives.

Zoho Invoice Pricing Plans Compared to Competitors

A direct comparison requires specifying competitors and their current pricing, which can fluctuate. However, generally speaking, Zoho Invoice sits in the mid-range. Competitors like FreshBooks often offer more expensive plans for similar functionality, while simpler options like Wave Accounting offer free plans with limited features. Zoho Invoice’s strength lies in its balance of affordability and feature richness, making it a good value for businesses that need more than basic invoicing but don’t require the most advanced, and often priciest, features found in enterprise-level solutions.

Zoho Invoice is great for managing client billing, but you gotta keep your system secure, right? Make sure you’re running a solid antivirus like malwarebytes free to protect your financial data and prevent any nasty surprises. Otherwise, all that meticulous Zoho Invoice work could be jeopardized by a virus. So, keep your invoicing and your computer healthy!

Zoho Invoice’s Value Proposition for Businesses

Zoho Invoice provides significant value by streamlining the invoicing process, reducing administrative overhead, and improving cash flow management. Its user-friendly interface makes it easy to create and send professional invoices, track payments, and manage expenses. The integration with other Zoho applications and third-party tools further enhances its value, enabling seamless workflow automation and data synchronization. The value proposition also includes features such as customizable invoices, recurring billing, expense tracking, and comprehensive reporting, which contribute to improved efficiency and better financial oversight.

Zoho Invoice Pricing Model and Business Growth

Zoho Invoice’s pricing model is designed to scale with business growth. As your business expands and your invoicing needs become more complex, you can upgrade to a higher-tier plan that offers more features and users. This scalability prevents businesses from being locked into a plan that no longer meets their requirements. For example, a small business starting with the basic plan might later upgrade to a professional plan as it expands its team and requires features like advanced automation and more users.

This allows businesses to optimize their spending while gaining access to necessary tools as they grow.

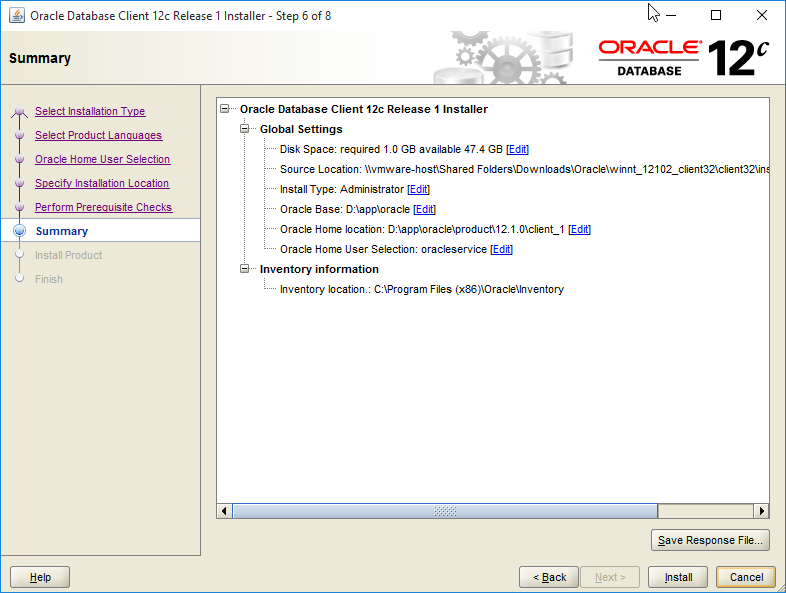

Comparison of Zoho Invoice Pricing Plans

| Feature | Free Plan | Basic Plan | Standard Plan | Professional Plan |

|---|---|---|---|---|

| Number of Invoices | Limited | 50 | 100 | Unlimited |

| Number of Clients | Limited | 50 | 100 | Unlimited |

| Number of Users | 1 | 1 | 3 | 5 |

| Recurring Invoices | No | Yes | Yes | Yes |

| Expense Tracking | No | Yes | Yes | Yes |

| Advanced Reporting | No | Limited | Yes | Yes |

| Payment Gateways | Limited | Limited | More Options | More Options |

| Price (USD/month, approximate) | Free | $10 | $20 | $30 |

Note

Pricing and features are subject to change. Please refer to the official Zoho Invoice website for the most up-to-date information.*

Closing Summary

From its user-friendly interface to its powerful reporting features and robust security measures, Zoho Invoice truly stands out as a comprehensive invoicing solution. Its flexibility caters to businesses of all sizes and industries, making it a versatile tool for managing your finances efficiently. By mastering Zoho Invoice’s capabilities, you can streamline your workflow, improve client communication, and ultimately, focus on what matters most – growing your business.

So, ditch the spreadsheets and embrace the power of streamlined invoicing with Zoho Invoice!

Questions Often Asked

Can I try Zoho Invoice for free?

Yes, Zoho Invoice offers a free plan with limited features, perfect for testing the waters before committing to a paid subscription.

What payment gateways does Zoho Invoice integrate with?

Zoho Invoice integrates with a variety of payment gateways, including PayPal, Stripe, and Authorize.Net, allowing you to accept payments from clients directly through the platform.

How do I handle recurring invoices in Zoho Invoice?

Zoho Invoice makes it easy to create and manage recurring invoices, ensuring your clients are billed automatically on a regular schedule. You can set up the frequency (daily, weekly, monthly, etc.) and customize the payment terms.

Is Zoho Invoice compatible with different currencies?

Yes, Zoho Invoice supports multiple currencies, making it ideal for businesses that work with international clients.

What kind of customer support does Zoho offer?

Zoho offers a range of support options, including email, phone, and live chat, as well as comprehensive online documentation and tutorials.