Tax software: It’s not exactly the most thrilling topic, right? But honestly, navigating taxes without it feels like trying to assemble IKEA furniture blindfolded. This deep dive explores the world of tax software, from the major players and their pricing schemes to the nitty-gritty of UI/UX design and the crucial issue of data security. We’ll unpack the features, benefits, and even the future of this surprisingly fascinating field.

We’ll cover everything from choosing the right software for your needs (are you a freelancer? An investor? A small business owner?) to understanding how these programs handle the ever-changing landscape of tax laws. Think of this as your cheat sheet to conquering tax season with a little less stress and a lot more efficiency. Plus, we’ll even touch on how AI might change the game in the years to come.

Market Overview of Tax Software

The tax software market is a dynamic and competitive landscape, constantly evolving to meet the changing needs of individuals and businesses. Driven by technological advancements and increasing tax complexity, the market shows consistent growth, with a diverse range of players vying for market share. This overview will explore the key aspects of this market, including major players, software types, pricing models, and key features.

Major Players and Market Trends

The tax software market is dominated by several key players, including Intuit (TurboTax), H&R Block (H&R Block Tax Software), TaxAct, and several smaller niche players catering to specific needs like tax professionals or specific business types. Market trends indicate a growing preference for online and mobile solutions, driven by convenience and accessibility. Furthermore, the integration of AI and machine learning is becoming increasingly prevalent, promising more efficient and accurate tax preparation.

The increasing complexity of tax laws and regulations also fuels demand for sophisticated software capable of handling intricate tax situations. For example, the ever-changing landscape of deductions and credits necessitates continuous updates and feature improvements from software providers.

Types of Tax Software

Tax software comes in various forms to cater to diverse user needs and preferences. Desktop software, like older versions of TurboTax, offers a comprehensive, offline experience, but requires installation and may lack the automatic updates of online versions. Online tax software, such as the current versions of TurboTax and H&R Block, provides accessibility from any device with an internet connection, often incorporating features like automatic data import and cloud storage.

Mobile tax software offers similar convenience as online versions, but with optimized interfaces for smaller screens. This segment is experiencing rapid growth due to the increasing smartphone penetration and the desire for on-the-go tax preparation. Each type caters to a different user preference; for example, users who prefer complete control and offline access may prefer desktop software, while those valuing convenience and accessibility might choose online or mobile options.

Pricing Models of Tax Software

Tax software pricing models vary significantly depending on the software, features included, and the complexity of the user’s tax situation. Many providers offer tiered pricing structures, with basic versions for simple returns and more advanced versions for those with complex incomes, investments, or business activities. Some software offers a free version with limited features, while others operate on a subscription model, providing access to features and updates for a recurring fee.

The cost can range from completely free to several hundred dollars depending on the chosen features and complexity of the tax return. For instance, a simple W-2 return might be prepared for free using a basic version, whereas a self-employed individual with numerous deductions and business expenses would likely need a more comprehensive, and therefore more expensive, software package.

Comparison of Leading Tax Software Products

| Feature | TurboTax (Intuit) | H&R Block | TaxAct |

|---|---|---|---|

| Pricing | Free to $100+ depending on the version | Free to $100+ depending on the version | Free to $50+ depending on the version |

| Online/Desktop/Mobile | Online, Mobile, Desktop (older versions) | Online, Mobile, Desktop (older versions) | Online, Mobile |

| Key Features | Import from prior year, AI assistance, Audit Support | Import from prior year, guided step-by-step process, customer support | Easy-to-use interface, accuracy checks, free filing for simple returns |

User Experience and Interface Design

Tax software, while necessary for many, often gets a bad rap for being clunky and confusing. A good user experience (UX) and a well-designed user interface (UI) are crucial for making tax preparation less stressful and more efficient. This section will explore the UI/UX of popular tax software, accessibility features, and examples of both effective and ineffective design choices.

We’ll also look at a potential UI improvement for a specific feature.

UI/UX Evaluation of TurboTax

TurboTax, a leading tax software program, generally offers a user-friendly interface, especially for simpler tax situations. The guided workflow helps users navigate the process step-by-step, minimizing confusion. However, the software can become overwhelming for users with complex tax situations, leading to a less positive experience. The abundance of pop-ups and prompts, while aiming to be helpful, can feel intrusive and distracting.

The search functionality could also be improved to more easily locate specific forms or information. While generally intuitive, the program’s complexity occasionally overshadows its user-friendliness, particularly for those unfamiliar with tax terminology or procedures.

Accessibility Features in Tax Software

Accessibility is a critical aspect of good UI/UX design. Different tax software options offer varying levels of accessibility features. For example, TurboTax offers screen reader compatibility and keyboard navigation, making it usable for visually impaired individuals. H&R Block also provides similar features, including adjustable text size and color contrast options. However, the level of accessibility varies across different features within each software.

Some features may be more accessible than others, highlighting the need for continuous improvement in this area. The lack of consistent accessibility standards across different platforms presents a challenge for users with disabilities.

Effective and Ineffective UI/UX Design Elements

Effective UI/UX design in tax software prioritizes clarity, simplicity, and efficiency. Clear instructions, intuitive navigation, and progress indicators contribute to a positive user experience. For example, a progress bar showing the completion percentage of the tax return preparation process can reduce user anxiety and provide a sense of accomplishment. In contrast, ineffective design often involves cluttered interfaces, confusing terminology, and poor error handling.

Overly complex forms, excessive use of jargon, and unclear error messages can frustrate users and lead to mistakes. For example, a poorly designed error message that doesn’t clearly indicate the source of the error can significantly hinder the user’s progress.

Improved User Interface Mock-up: Itemized Deduction Input

Let’s consider the itemized deduction input section. Many tax software programs present this as a long, potentially daunting list of fields. An improved UI could group related deductions (e.g., medical expenses, charitable contributions) into collapsible sections with clear labels and helpful tooltips. Instead of a simple list, a visually appealing card-based system could be used, with each card representing a deduction category.

Each card would have a summary of the deduction, an expandable section for detailed input, and a clear indication of any supporting documentation required. This approach would improve organization, reduce visual clutter, and make the process of entering itemized deductions significantly more user-friendly. The visual design could utilize a color-coded system to further enhance organization and clarity.

For instance, medical expenses could be represented by a light blue card, charitable contributions by a light green card, and so on. This would improve scannability and allow users to quickly identify and navigate to specific sections.

Features and Functionality

Modern tax software offers a range of features designed to simplify tax preparation, from basic data entry to sophisticated tax planning tools. The specific features and their effectiveness vary depending on the software package and the complexity of the user’s tax situation. Choosing the right software involves understanding these functionalities and how they align with individual needs.

Core Features of Modern Tax Software

Most tax software packages share a core set of features aimed at streamlining the tax filing process. These typically include guided interviews to gather necessary information, accurate calculation of taxes owed or refunds due, electronic filing capabilities, and support for various tax forms. Many also offer features to help users identify potential deductions and credits they might otherwise miss.

For example, a common feature is an automated search for eligible deductions based on the information provided, such as charitable donations or home office expenses. This significantly reduces the chance of overlooking valuable deductions. The software also usually includes built-in error checking to prevent common mistakes, ensuring a more accurate return.

Tax Preparation Capabilities for Different Tax Situations

Tax software caters to a variety of tax situations. Software designed for self-employed individuals typically includes features to handle Schedule C (Profit or Loss from Business), Schedule SE (Self-Employment Tax), and other forms relevant to business income and expenses. For investors, features supporting the reporting of capital gains and losses (Schedule D), dividend income, and interest income are crucial.

High-net-worth individuals might need software that handles more complex tax situations, such as trusts, estates, and international taxation, which simpler programs might not support. For example, TurboTax Premier offers more advanced features for investors and self-employed individuals compared to TurboTax Free, highlighting the tiered nature of functionality based on user needs. H&R Block Premium similarly offers expanded capabilities compared to its free version.

Integration with Other Financial Tools

Increasingly, tax software is integrating with other financial tools to improve efficiency and accuracy. Integration with accounting software allows for seamless transfer of financial data, reducing manual data entry and the risk of errors. Linking with banking apps can automate the import of income and expense information, further streamlining the tax preparation process. For example, some software can directly import transaction data from bank accounts and credit card statements, automatically categorizing them based on predefined rules or machine learning algorithms.

This integration reduces the time spent manually entering financial information, leading to a more efficient workflow.

Advanced Features of Premium Tax Software Packages

Premium tax software packages often include advanced features not found in free or basic versions. These can include tax planning tools that allow users to model different tax scenarios, helping them optimize their tax strategies. Some offer expert assistance through live chat or phone support, providing guidance on complex tax issues. State tax preparation capabilities are often included, simplifying the process for taxpayers filing in multiple states.

Other advanced features may include features such as audit support, offering assistance in case of an IRS audit, or tools for tax projections, which allow users to estimate their tax liability for the following year based on current income and expenses. These premium features generally justify their higher price point by offering greater support and more comprehensive tax planning capabilities.

Security and Data Privacy

Protecting your sensitive financial information is paramount when using tax software. Leading providers understand this and employ a range of robust security measures to safeguard your data. Compliance with relevant regulations is also critical, ensuring your privacy rights are protected. This section explores the security protocols employed by major players and offers best practices for users.

Security Measures Implemented by Leading Tax Software Providers

Major tax software companies utilize a multi-layered approach to security. This typically includes encryption of data both in transit (using protocols like HTTPS) and at rest (using strong encryption algorithms). They also employ firewalls and intrusion detection systems to monitor and prevent unauthorized access. Regular security audits and penetration testing are conducted to identify and address vulnerabilities proactively.

Furthermore, many providers utilize multi-factor authentication (MFA) to add an extra layer of protection, requiring users to verify their identity through multiple methods before accessing their accounts. Robust password policies are also enforced, requiring strong, unique passwords to deter unauthorized access.

Compliance with Data Privacy Regulations

Tax software providers must comply with various data privacy regulations, most notably the California Consumer Privacy Act (CCPA) and the European Union’s General Data Protection Regulation (GDPR). Compliance involves implementing measures to ensure data is collected, used, and stored in accordance with these regulations. This includes providing users with clear and concise privacy policies, obtaining explicit consent for data collection, and offering users control over their data, including the right to access, correct, or delete their information.

Regular internal audits and external assessments are often conducted to ensure ongoing compliance.

Best Practices for Ensuring Data Security When Using Tax Software

Users can also take steps to enhance their data security. Choosing reputable tax software providers with a strong security track record is crucial. Always use strong, unique passwords and enable multi-factor authentication if offered. Be wary of phishing scams and avoid clicking on suspicious links or attachments in emails. Regularly review your account activity and report any suspicious behavior immediately.

Keep your software updated with the latest security patches to address any known vulnerabilities. Finally, consider using a strong password manager to securely store and manage your passwords.

Comparison of Security Protocols: TurboTax vs. TaxAct

While both TurboTax and TaxAct are major players in the tax software market, their security protocols differ slightly in emphasis. TurboTax, for example, heavily emphasizes its use of 256-bit AES encryption for data at rest and in transit, alongside its robust fraud detection system. TaxAct, on the other hand, highlights its SOC 2 Type II compliance, demonstrating a commitment to established security standards and regular audits.

Both platforms offer multi-factor authentication and utilize firewalls and intrusion detection systems. Ultimately, both provide a high level of security, though the specific implementation details vary. The choice between them often comes down to personal preference and specific features.

Customer Support and Resources

Choosing tax software is about more than just the features; reliable customer support is crucial, especially when wrestling with complex tax laws. A responsive and helpful support system can turn a frustrating experience into a smooth one, saving you time and stress during tax season. This section explores the various support options offered by different tax software companies and examines what constitutes effective and ineffective support.

Tax software companies generally offer a range of support resources to assist users. The quality and availability of these resources vary significantly, impacting the overall user experience. Understanding the different support options and identifying which ones are most effective is key to choosing the right software for your needs.

Types of Support Resources

Tax software companies typically offer a multi-faceted approach to customer support. This often includes a comprehensive FAQ section addressing common questions, interactive tutorials demonstrating software functionalities, email support for less urgent inquiries, and phone support for immediate assistance with complex issues. Some companies also offer live chat support for quick answers to simple questions. The availability and quality of these resources differ between providers.

For example, TurboTax is known for its extensive online resources and readily available phone support, while H&R Block’s online support might be less comprehensive, emphasizing in-person assistance in some cases.

Examples of Effective and Ineffective Customer Support Interactions

Effective customer support involves prompt responses, knowledgeable agents, and clear solutions. For instance, a positive experience might involve a phone agent quickly identifying and resolving a software glitch, providing clear step-by-step instructions, and following up to ensure the issue is fully resolved. Conversely, ineffective support might entail long wait times, unhelpful or dismissive agents, or a failure to provide a satisfactory resolution.

An example of poor support could be an email inquiry that goes unanswered for days, or a phone agent who is unable to understand the problem and offers generic, unhelpful advice.

Troubleshooting Common Tax Software Issues

Navigating tax software can sometimes present challenges. Here’s a guide outlining best practices for troubleshooting common issues:

Before contacting support, try these steps:

- Check the FAQ section: Many common issues are addressed in the frequently asked questions section of the software’s website. This is often the quickest and easiest way to find a solution.

- Review online tutorials: Many software providers offer video tutorials or written guides that walk users through various processes. These can help clarify confusing aspects of the software.

- Restart your computer: A simple restart can resolve temporary software glitches.

- Check your internet connection: Poor internet connectivity can cause problems with software functionality.

- Update your software: Ensure you’re using the latest version of the tax software. Updates often include bug fixes and performance improvements.

If these steps don’t resolve the issue, contact customer support. Be prepared to provide specific details about the problem, including error messages, screenshots, and the steps you’ve already taken.

Integration with Accounting Software

Integrating your tax software with your accounting software is a total game-changer for efficiency and accuracy. Think of it like this: instead of manually transferring data, you’re automating a huge chunk of your tax prep, saving you tons of time and reducing the risk of errors. This seamless flow of information streamlines the entire process, from recording transactions to filing your return.The benefits of integrating tax and accounting software are pretty clear.

It significantly reduces the time spent on data entry, minimizing the chance of human error. This translates directly to cost savings, both in terms of labor and the potential penalties for inaccurate filings. Plus, having all your financial data in one place improves your overall financial management and provides a more comprehensive view of your business’s health.

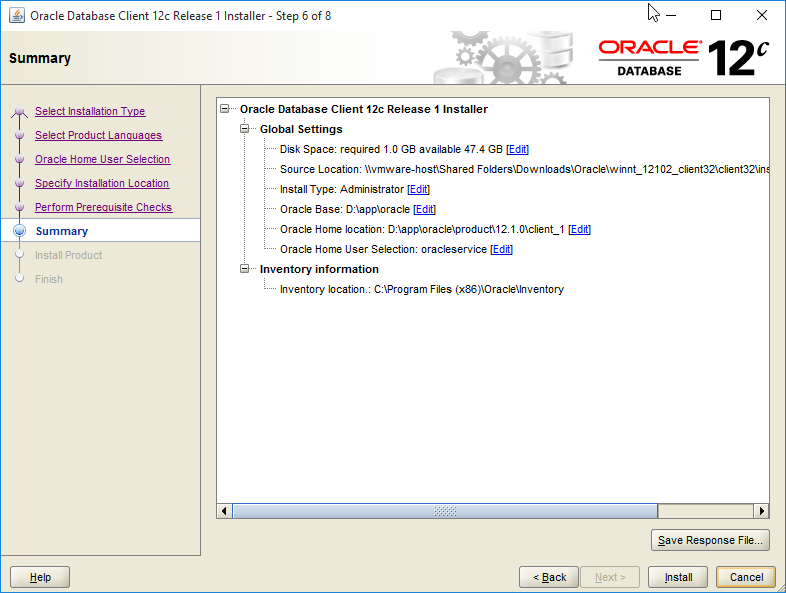

Integration Capabilities of Different Software Combinations

The level of integration varies widely depending on the specific tax and accounting software you use. Some offer direct, real-time data syncing, while others might require exporting data files and importing them into the other program. For example, TurboTax and QuickBooks Online have a robust integration, allowing for nearly seamless data transfer. However, a smaller, less-known tax software might only offer a basic CSV import/export feature with a less streamlined process, requiring more manual intervention.

The best approach is to research the specific integration capabilities offered by the software combinations you are considering, paying close attention to the features and the level of automation provided.

Data Transfer Processes Between Tax and Accounting Software

The process of transferring data generally involves either direct integration or file-based transfer. Direct integration uses APIs (Application Programming Interfaces) to establish a real-time connection between the two programs. Changes made in one software are automatically reflected in the other. File-based transfer involves exporting data from the accounting software (often as a CSV, QBO, or other file format) and then importing it into the tax software.

This method is less efficient but works even if the software aren’t directly compatible. The choice depends on the capabilities of your chosen software and your comfort level with technical processes.

Data Transfer Workflow: A Hypothetical Scenario

Let’s imagine Sarah owns a small bakery and uses QuickBooks Online for her accounting and TurboTax Self-Employed for her taxes. At the end of the tax year, Sarah completes her bookkeeping in QuickBooks Online. Thanks to the integration between QuickBooks and TurboTax, she can initiate a data transfer directly within TurboTax. The software automatically pulls the necessary financial information – income, expenses, deductions – from QuickBooks Online.

TurboTax then uses this data to pre-populate relevant sections of the tax return, minimizing manual entry and ensuring accuracy. Sarah can review the imported data, make any necessary adjustments, and then file her return with confidence, knowing the data is consistent and reliable. This process contrasts sharply with the manual process of printing reports from QuickBooks, manually entering data into TurboTax, and painstakingly double-checking everything.

Impact of Tax Law Changes

Tax laws are constantly evolving, presenting a significant challenge for tax software developers and users alike. Keeping tax software up-to-date requires a robust and agile development process, capable of quickly adapting to new regulations and ensuring accuracy for users. The impact of these changes ripples through every aspect of the software, from the user interface to the underlying calculations.Tax software adapts to changes in tax laws and regulations through a multifaceted approach involving continuous monitoring, rapid development cycles, and rigorous testing.

Developers rely heavily on official government publications, legal experts, and industry updates to stay abreast of impending changes. This information fuels the process of updating the software’s code, user interface elements, and help documentation. The goal is seamless integration of new rules without disrupting the user experience, while maintaining accuracy and compliance.

Challenges in Keeping Up with Tax Law Updates, Tax software

The frequency and complexity of tax law changes pose significant hurdles for tax software developers. The sheer volume of legislative updates, often with short implementation deadlines, necessitates a highly efficient development pipeline. Furthermore, interpreting the nuances of new legislation and translating them into accurate software algorithms requires specialized expertise and thorough testing to avoid errors and ensure compliance.

Unexpected changes or ambiguities in the legislation can create additional delays and necessitate further revisions. For example, the introduction of the Tax Cuts and Jobs Act of 2017 required extensive re-engineering of many tax software programs, impacting features related to individual and corporate tax calculations, deductions, and credits. The quick turnaround time needed for updates adds pressure to developers to balance speed with accuracy.

Updating Tax Software to Reflect New Tax Laws

The process of updating tax software typically involves several key stages. First, developers carefully analyze the new tax legislation, identifying all relevant changes and their implications for the software’s functionality. Next, they modify the software’s code to incorporate these changes, ensuring that all calculations, forms, and user prompts accurately reflect the updated laws. This step often requires extensive testing to verify the accuracy and reliability of the updated code.

Finally, the updated software is thoroughly reviewed by legal and quality assurance teams before being released to users, often through automatic updates or downloadable patches. This meticulous process is crucial for ensuring the continued accuracy and compliance of the tax software.

Examples of Tax Law Changes Impacting Software Features

Several examples illustrate the impact of tax law changes on tax software features. The introduction of the Affordable Care Act (ACA) mandated the inclusion of new forms and calculations related to health insurance subsidies and penalties. Similarly, changes to the standard deduction amounts or itemized deduction rules require modifications to the software’s calculation engine and user interface elements to guide users through the updated process.

The expansion or contraction of tax credits, such as the child tax credit, necessitate adjustments to the software’s eligibility criteria and calculation logic. These changes often require developers to adapt existing features or introduce entirely new ones to accommodate the revised tax rules. The ongoing evolution of tax laws necessitates continuous adaptation of tax software to maintain its relevance and accuracy.

Future Trends in Tax Software

The tax software landscape is constantly evolving, driven by technological advancements and changing user needs. We’re seeing a shift towards more intuitive interfaces, increased automation, and a greater emphasis on data security and integration. The future of tax software promises even greater efficiency and accuracy for both individuals and businesses.The integration of artificial intelligence (AI) and machine learning (ML) is arguably the most significant trend shaping the future of tax software.

These technologies are poised to revolutionize how we prepare and file taxes, leading to a more streamlined and less error-prone process.

Artificial Intelligence and Machine Learning in Tax Software

AI and ML are already being used in various aspects of tax software, from basic data entry automation to complex tax optimization strategies. For example, some software now uses ML algorithms to analyze a user’s financial data and identify potential deductions or credits they might have overlooked. In the future, we can expect even more sophisticated applications of AI and ML.

Imagine software that can automatically categorize transactions, reconcile accounts, and even predict future tax liabilities based on historical data and anticipated income changes. This level of automation would free up significant time for tax professionals and individuals, allowing them to focus on higher-level strategic planning rather than tedious data entry. For example, a small business owner could use AI-powered software to analyze sales data and forecast tax obligations for the upcoming year, allowing for better financial planning and resource allocation.

Enhanced User Experience and Personalization

Tax software is increasingly moving beyond simple form-filling applications. Future iterations will likely incorporate personalized guidance and adaptive learning features. The software could learn a user’s tax history and preferences, tailoring the experience to their specific needs. For example, a first-time homebuyer might receive personalized prompts and guidance on claiming relevant deductions, while a seasoned investor might access more advanced features for managing capital gains and losses.

This level of personalization will make tax preparation more accessible and less intimidating for users of all skill levels. Think of it like a personalized tax coach built into the software.

Predictive Analytics and Tax Planning

The integration of predictive analytics will transform tax preparation from a retrospective exercise to a proactive planning tool. By analyzing historical data and market trends, the software could anticipate potential tax implications and offer personalized recommendations for optimizing tax outcomes. For instance, the software might suggest adjusting investment strategies or making charitable contributions to minimize tax liabilities. This proactive approach will empower users to make informed financial decisions throughout the year, not just during tax season.

Consider a scenario where the software alerts a user about upcoming changes in tax law that could significantly impact their tax burden, allowing them to adjust their financial strategy accordingly.

A New Feature Concept: Real-Time Tax Impact Visualization

A significant limitation of current tax software is the difficulty in visualizing the real-time impact of different financial decisions on one’s overall tax liability. A new feature could address this by providing interactive dashboards that dynamically update as users input financial data. For example, a user could see how a change in their charitable contributions affects their taxable income and overall tax bill in real-time.

This visual representation would significantly enhance user understanding and empower more informed financial decisions. The dashboard could also provide comparative analyses, showing the tax implications of different investment strategies or retirement planning scenarios. This feature would be especially valuable for users who want to understand the consequences of their financial decisions before making them.

Case Studies of Tax Software Use

Tax software has revolutionized tax preparation, offering significant benefits to individuals and businesses of all sizes. Its impact spans from simplifying individual returns to streamlining complex corporate tax filings, ultimately saving time, reducing errors, and optimizing tax outcomes. The following case studies illustrate the diverse applications and advantages of utilizing tax software.

Individual Taxpayer Scenario: The Freelancer

Sarah, a freelance graphic designer, previously spent countless hours manually calculating her self-employment taxes, often feeling overwhelmed by the complexities of deductions and credits. Switching to tax software significantly improved her experience. The software guided her through each step, automatically calculating her self-employment tax liability, and identifying eligible deductions like home office expenses and business-related travel. This resulted in a more accurate return and significantly reduced her preparation time, allowing her to focus on her design work.

The software’s intuitive interface and helpful prompts made the process straightforward, even for someone unfamiliar with tax regulations. Compared to her previous manual method, using tax software saved her approximately 10 hours and minimized the risk of errors leading to potential audits or penalties.

Small Business Scenario: The Local Bakery

“Sweet Success,” a small local bakery, used to rely on a traditional accounting system and manual tax preparation. This proved time-consuming and error-prone, especially during peak seasons. After adopting tax software, the bakery’s owner, Maria, experienced a dramatic improvement in efficiency. The software integrated seamlessly with her accounting software, automatically importing relevant financial data. This eliminated manual data entry, a significant source of errors in their previous system.

Furthermore, the software provided valuable insights into their tax obligations, helping Maria optimize deductions and plan for future tax liabilities. The time saved allowed Maria to focus on managing her business and improving customer service. The reduction in errors also resulted in significant cost savings by avoiding potential penalties and audits.

Large Corporation Scenario: The Multinational Conglomerate

GlobalTech, a multinational corporation with operations in multiple countries, utilizes sophisticated tax software to manage its complex tax obligations. The software’s advanced features, including international tax compliance capabilities and automated reporting functions, streamline the process of preparing consolidated tax returns. The software’s ability to handle diverse tax jurisdictions and regulations minimizes the risk of non-compliance and associated penalties.

Compared to manual preparation, which would require a large team of tax professionals and substantial time investment, the software significantly reduces the time and cost associated with tax preparation. The accuracy and efficiency provided by the software are critical for a company of GlobalTech’s size and complexity. Real-time reporting and data analysis features also allow GlobalTech to proactively manage its tax liabilities and optimize its tax strategy.

Tax software can be a real headache, especially when you’re dealing with a bunch of deductions and credits. To keep everything straight, I find it super helpful to visually organize my tax info first using a mind map maker before I even start inputting data into the software. That way, I can easily see where everything fits and avoid any annoying mistakes.

It makes the whole tax process way less stressful!

Case Study: Utilizing Tax Software for a Rental Property

John owns a rental property and previously struggled with accurately calculating depreciation, rental income, and expenses. He found that manual calculations were prone to errors and very time-consuming. By using tax software designed for rental properties, he was able to easily input all relevant information, including rental income, mortgage interest, property taxes, insurance, and repairs. The software automatically calculated depreciation using various methods, ensuring accuracy and compliance with tax regulations.

The software also generated reports summarizing his rental income and expenses, simplifying the process of preparing his tax return. This streamlined process saved John considerable time and reduced the risk of errors, allowing him to focus on managing his rental property rather than spending hours on tax preparation. His overall tax liability was accurately determined, maximizing deductions and minimizing his tax burden.

Outcome Summary: Tax Software

So, there you have it – a whirlwind tour through the world of tax software. From simplifying complex tax returns to ensuring your data stays safe and sound, the right software can make all the difference. While the market is constantly evolving, the core need remains: a user-friendly, secure, and efficient way to manage your taxes. Ultimately, choosing the right tax software boils down to finding the perfect fit for your specific needs and comfort level.

Happy filing!

Questions Often Asked

What’s the difference between desktop and online tax software?

Desktop software is downloaded and installed on your computer, while online software is accessed through a web browser. Desktop versions usually offer more offline functionality, but online options often have automatic updates and better collaboration features.

Can I import my data from other financial tools?

Many tax software programs integrate with accounting software, banking apps, and investment platforms, allowing you to import relevant financial data to simplify the tax preparation process. Check the specific software’s features for compatibility.

How do I know if my tax software is secure?

Look for software that uses encryption, two-factor authentication, and regular security audits. Reputable companies will clearly Artikel their security protocols and data privacy policies. Read reviews and compare different options before making a decision.

What if I have a problem with the software?

Most tax software providers offer various support options, including FAQs, tutorials, phone support, and email assistance. Check their website for contact information and support resources. Many also offer live chat support during peak tax season.

Is tax software only for complicated returns?

Nope! Even if your taxes are relatively straightforward, tax software can still save you time and effort by guiding you through the process, performing calculations, and helping you avoid common errors. It’s a helpful tool for everyone.